Art Market Update

How will Art lovers respond to the global crisis ?

Modern and Contemporary African Art

Will this growth area continue to make gains?

April 22, 2020

CHÉRI SAMBA (DEMOCRATIC REPUBLIC OF CONGO, b. 1956), Le collège de la Sagesse, 2005, acrylic on canvas. Image courtesy of Bonhams

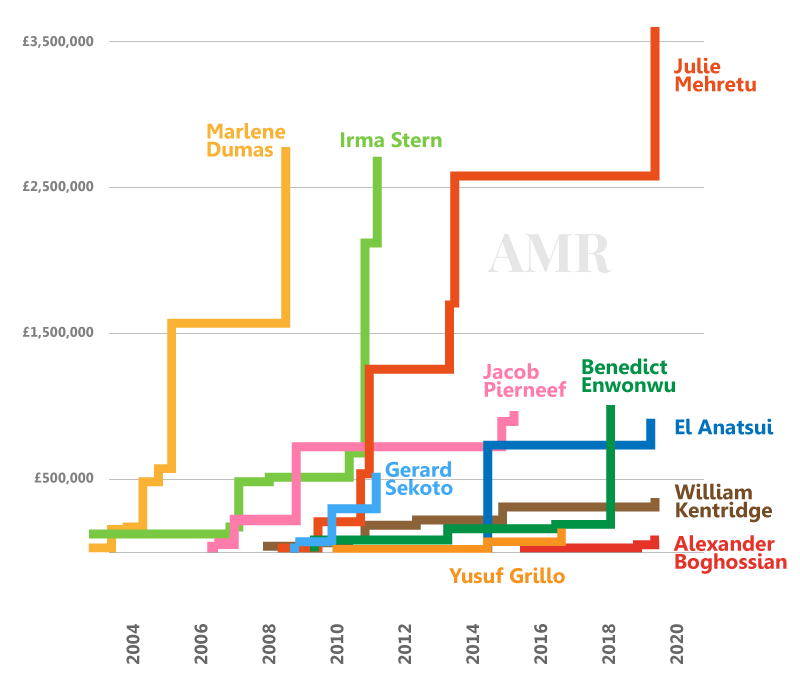

There are currently twelve African artists in AMR’s list of Top 1000 artists. Before 2008 there were only three – Marlene Dumas, Irma Stern and Jacob Pierneef.

The auction market for South African Art really started to grow after a series of sales organised by Bonhams between 2007 and 2009. The highlight was a two-day sale at their Knightsbridge saleroom in September 2008 when 250 lots generated over £7 million in sales. The success prompted Bonhams to launch twice yearly sales of works by Contemporary African artists in 2009. The sale included works by artists from across the continent, including now familiar names such as Benedict Enwonwu, Yusuf Grillo and El Anatsui. Originally called Africa now, Bonhams’ Modern And Contemporary African sales now take place in London and New York.

The chart below compares individual artist records for several of the best-known African artists. After early successes of Post-War South African artists, the evolution of auction records illustrates how the market has embraced Contemporary African artists over recent years. (Each step turn to the right represents previous auction records.)

Individual Artists records at Auction 2004-2020

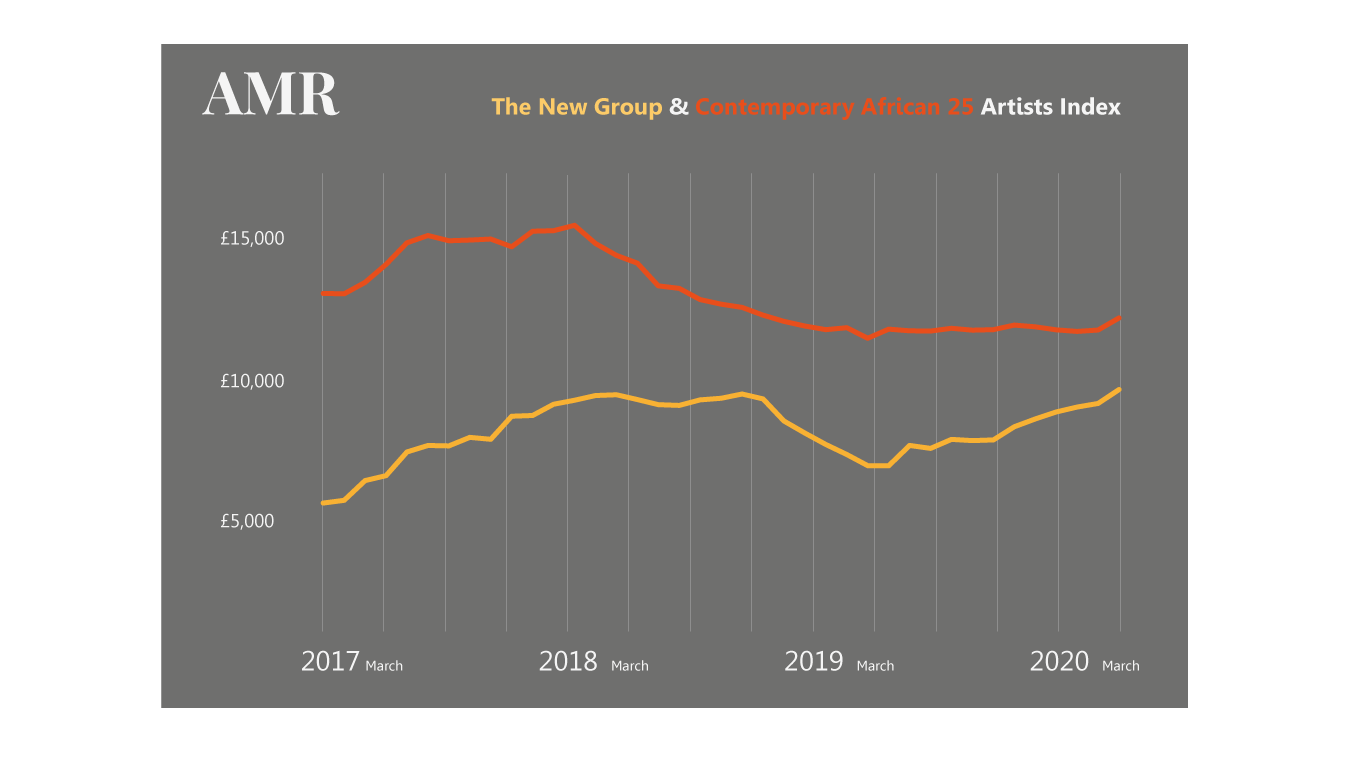

‘The New Group’ of artists were a loose collective of like-minded South Africans who exhibited their work between the late 1930s and early 1950s. Almost all white, the main aim of the group was to move South African art away from themes centred around nationhood which had been practised by their predecessors. Summarised in their manifesto, the new direction was; ‘To raise the standard of art in South Africa’. The most highly regarded of these artists is Irma Stern, whose work currently holds the auction record for the group. Interest in Stern’s prolific output continues with fifteen of her works selling between £100,000 and £900,000 (excl. fees) over the last 15 months. An index of average values for 16 artists of the New Group shows a rise of 60% from an index low in January 2017 (see Chart).

Recent sales at Bonhams and Sotheby’s Modern and Contemporary African art auctions include fewer and fewer works by the New Group. An Index of 25 Contemporary African artists appearing in these sales grew 257% between 2013 and 2020. Giles Peppiatt, Specialist at Bonhams African department sees a wide range of collectors at the auctions. Collector’s tastes tend to differ by region. Collectors in West Africa like to stick with Post-War works while it makes sense to sell more contemporary pieces in New York.”

A host of celebrities such as Jay-Z and Beyonce, Justin Bieber and basketball player Grant Hill are known to collect Blue Chip Contemporary artists. But will some celebrity collectors follow in the footsteps of CNN anchor Anderson Cooper who’s known to have bought works by Toyin Ojih Odutola and Njideka Akunyili Crosby? “New York is also a good place to introduce wealthy collectors of African-American Art to the Contemporary African market. Recent sales suggest the idea is already paying dividends.” Continues Peppiatt.”

The New Group & Contemporary African 25

Online Sales of African Art went ahead at Bonhams and Sotheby’s in March and April amidst government lockdowns in the wake of the Coronavirus pandemic. Results remained consistent with those in 2019. On 2nd April, the number of sold lots at Sotheby’s was up 4% on 2019 (although those selling above estimate were slightly down). At Bonhams sale on 18 March, the number of sold lots was down 12% on 2019, while those going over the estimate was 4% up.

Bonham’s have three more sales coming up this year. Peppiatt is confident that solid growth over recent years will continue; ‘Obviously, everyone would like better conditions but the works on offer are good quality and so there’s no reason to be downbeat ahead of the sales. We have one online auction with some very affordable works and given everyone has more time on their hands we are expecting good results.’

Text & Infographics: Copyright © 2020 Art Market Research, All Rights Reserved

Note on METHODOLOGY

AMR collects data from leading auction houses worldwide providing a statistical sample of global sales at auction every month. Buyer’s Premiums levied by auction houses are removed and hammer prices recorded. Works are individually sorted and filtered and categorised by medium to produce consistent, high quality data which is fit for purpose. Statistical outliers (data points that differ significantly from other observations) are removed (trimmed) and a times-series methodology is applied in order to identify trends. Read more on AMR methodology here.

Disclaimer: This Art Market Update is not intended as investment advice and nor does AMR warrant that the information contained in the Update can be used for investment purposes. For more information on terms and conditions please go to Terms of Use

For more information on AMR’s custom research contact s.duthy@artmarketresearch.com

AMR’s indexes have been tracking market trends on Art, Antiques and Collectibles since the 1970s. Our large suite of indexes are available at the touch of a button via our online ‘Create an Index Service’.

Coins, Cars and Banksy

Social distancing enables collectors to spend quality time with their loved ones but also their collections…

March 31, 2020

As the lockdown goes global, auction houses are increasingly switching to online only or private sales. But observing government rules on social distancing, still frustrates business built around the marketplace. AMR’s experts collect data on a wide range of fine art, antiques and collectables and we’ve spoken to them about the unprecedented changes auction houses are making to stay in business.

CARS

Car auctioneers are accustomed to sold lots leaving under their own fumes and so they probably have most to lose under the current restrictions on social distancing. Bonham’s Goodwood 2020 event may have been cancelled, but the sale went ahead until the deadline on Sunday. Bonham’s website indicates that just 11 out of the 185 lots were sold as many clients are unwilling to spend if they can’t collect their cars. Brightwells have chosen to run online sales for modern cars and Ministry of Defence vehicles only. To make life a little easier, they are waiving their usual storage charge during the lockdown, normally up to £25 a day. With immediate payment for lots still expected, however, only a few collectors will be in the mood to keep shopping. Enthusiasts are already grabbing the opportunity to get on with home restorations, and parts suppliers are currently staying open to cope with the demand. Once restrictions are lifted, expect plenty of newly-restored/fettled cars coming on the market.

COINS

With scrap prices for silver shooting up recently, the forced closures will be frustrating for auctioneers at the lower end of the market for silver. At the top, Woolley and Wallis have had to postpone their quarterly sale in April while Cheffins of Cambridge and Sworders have also announced postponements.

One precious metal which was moving in the collectables market were British coins at Spink and son last week (March 24). Writing in an email, CEO Olivier D. Stocker told clients that sales would continue because “ in addition to spending quality time with their loved ones, quite a few will spend more time with their personal collections to try to take their mind away from the current Covid19 crisis and its trail of desolation.” Stocker looks to have been spot on as the sale was over 95% sold. AMR’s index of Milled English Gold coins shows a fall of 17% in average values over the past three years after reaching a peak in December 2015. With 68% of lots going for high estimate or over, the industry will be encouraged by the interest shown last week. The highlight of the sale was a gold George IV five-pound coin which sold £55,000, well over double its high estimate.

George IV gold five-pound coin which sold £55,000, well over double its high estimate. Source: Spink’s

Banksy (b. 1974), Love is in the bin (originally Baloon Girl), spray paint and acrylic on canvas, mounted on board, in artist’s frame 101 by 78 by 18 cm, Executed in 2006, this work is unique. It was sold at Sotheby’s London Contemporary Art Evening auction on Oct 5, 2018, for 1,042.000 GBP (incl. fees) against the estimate 200,00 – 300,000 GPB. Source: Sotheby’s /https://www.sothebys.com/en/articles/latest-banksy-artwork-love-is-in-the-bin-created-live-at-auction?locale=en

BANKSY

While Christie’s scheduled sales are currently under review, Sotheby’s continue with a much reduced service. Initially slow to clarify their position, the auction house posted a statement on Sunday stating that while the company is; “technologically equipped to operate a variety of scenarios… based on conversations with consigners and bidders, we are considering a number of formats to provide for sales to proceed in the most effective manner”.

Last week’s sale of Banksy’s prints at Sotheby’s was a slight improvement on last year’s inaugural sale. The sale total of £1,09m last week also produced a higher lot average than the previous year with more lots sold on or above the high estimate (79%).

The highlight was a rare screen print of ‘Girl with Balloon’ which sold for £300,000 (excl. fees). One of an edition of 88 artist proofs produced in 2004, the balloon is pinker than the rich red printed in later runs. The original artwork of ‘Girl with Balloon’ first appeared outside a Shoreditch shop in 2002 and then on London’s Southbank. An initial edition of 600 was produced by the artist in 2004 followed by second edition of 150 a year later. Ten screen prints of the work, including two artist proofs, have sold in the last year. Perhaps the artist’s most famous work, the glut shows no sign of diminishing the value of this signature piece. Prices have ranged from £50,000 to £320,000 with a premium put on lots with unique identifying features. Any damage, such as the work being cut down, can knock £10,000 off the price.

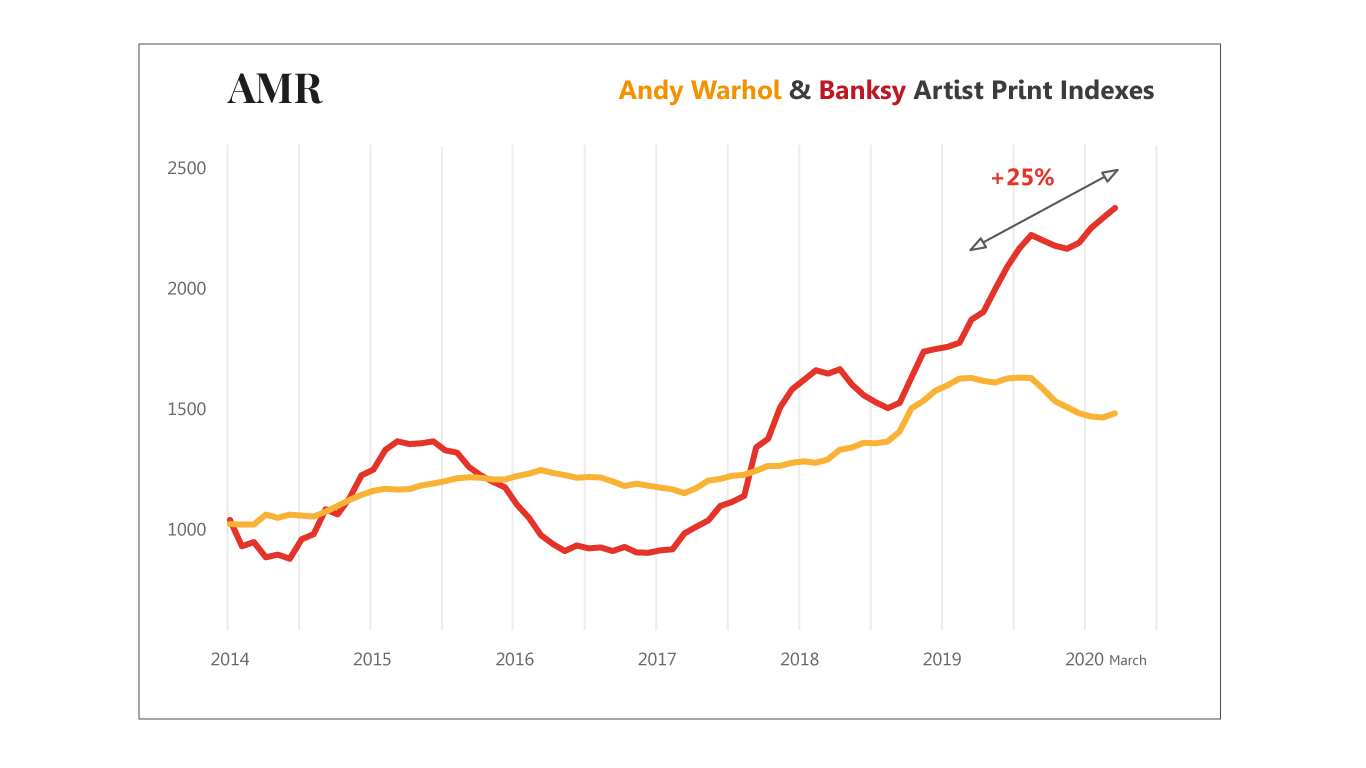

The chart compares sales from all of Banksy’s print editions with Andy Warhol’s sales of screen prints between 2014 and March 2020. Prices for Banksy prints have been up and down over the last decade but started to climb again in the last three years (overtaking a previous peak in 2011). Banksy also produces original, unique works which occasionally come to auction. Average values for these remained constant for many years until a painting of ‘Girl With Balloon’ was shredded in front of shocked buyers at an auction of the work in 2018. Rumoured to have been a stunt by the artist, Sotheby’s subsequently issued a statement saying that; “The new work has been granted a certificate by Pest Control, Banksy’s authentication body, and has been given a new title, Love is in the Bin.” Since 2010, values of Andy Warhol’s Screen prints rose steadily but reached a peak in 2019. Sales of Warhol’s work at Sotheby’s and Christie’s were disappointing in March after a year of falling values (see previous AMR update).

Note on METHODOLOGY

AMR collects data from leading auction houses worldwide providing a statistical sample of global sales at auction every month. Buyer’s Premiums levied by auction houses are removed and hammer prices recorded. Works are individually sorted and filtered and categrorised by medium to produce consistent, high quality data which is fit for purpose. Statistical outliers (data points that differ significantly from other observations) are removed (trimmed) and a times-series methodology is applied in order to identify trends. The information supplied to the ‘Christie’s and Sotheby’s Prints & Multiples’ Index contains sales of prints and multiples at any one of the auction houses from which AMR collects its data. For more information on methodology, please visit AMR Methodology page.

Disclaimer: This Art Market Update is not intended as investment advice and nor does AMR warrant that the information contained in the Update can be used for investment purposes. For more information on terms and conditions please read AMR Terms of Use.

- For more information on AMR’s Prints & Multiples indexes you can contact s.duthy@artmarketresearch.com

Text & Graphs Copyright © 2020 Art Market Research, All Rights Reserved

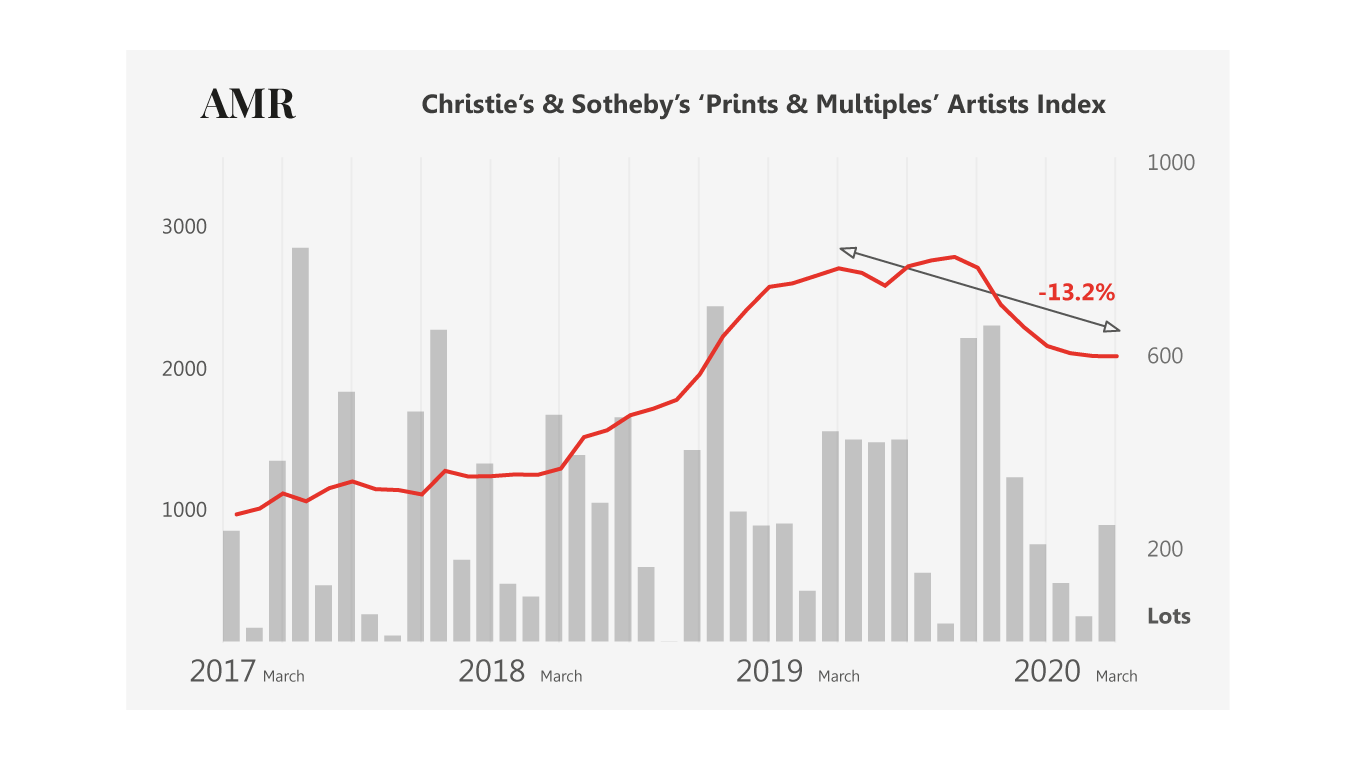

Prints & Multiples

Tracking the remaining sales at auction during the global crisis, we’ve analysed sales results at Christie’s and Sotheby’s Print and Multiple sales taking place in London last week before the live sales werel shut down. A regular fixture of the spring and autumn auction calendar, many of the works by artists from Canaletto, Dürer and Rembrandt to Goya, Richter and Warhol have appreciated considerably in value over the last decade. AMR’s index of 100 top selling print-makers reveals that average values in the 10 years to March 2019 rose 218%. This growth peaked around March 2019 – in line with similar trends across the wider auction market for art.

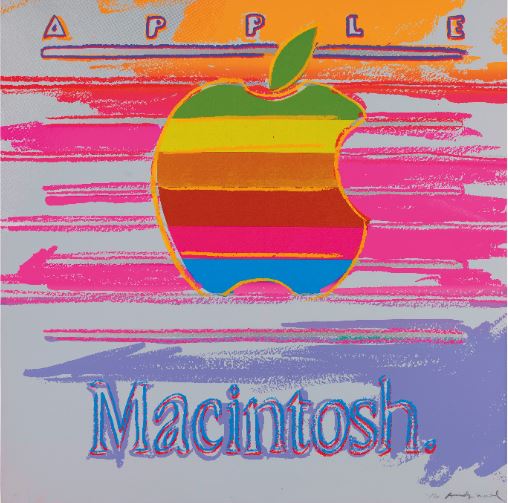

Given the major Warhol retrospective at London’s Tate Modern, there were mixed results at last weeks sales. The artist’s ‘Madonna & Self-Portrait with Skeleton’s Arm (after Munch)’ failed to find a buyer. On the other hand, a unique colour variant of Warhol’s ‘Apple, from: Ads’ also offered by Christie’s stood out, selling for £115,000 (excl. fees) over a high of £70,000.

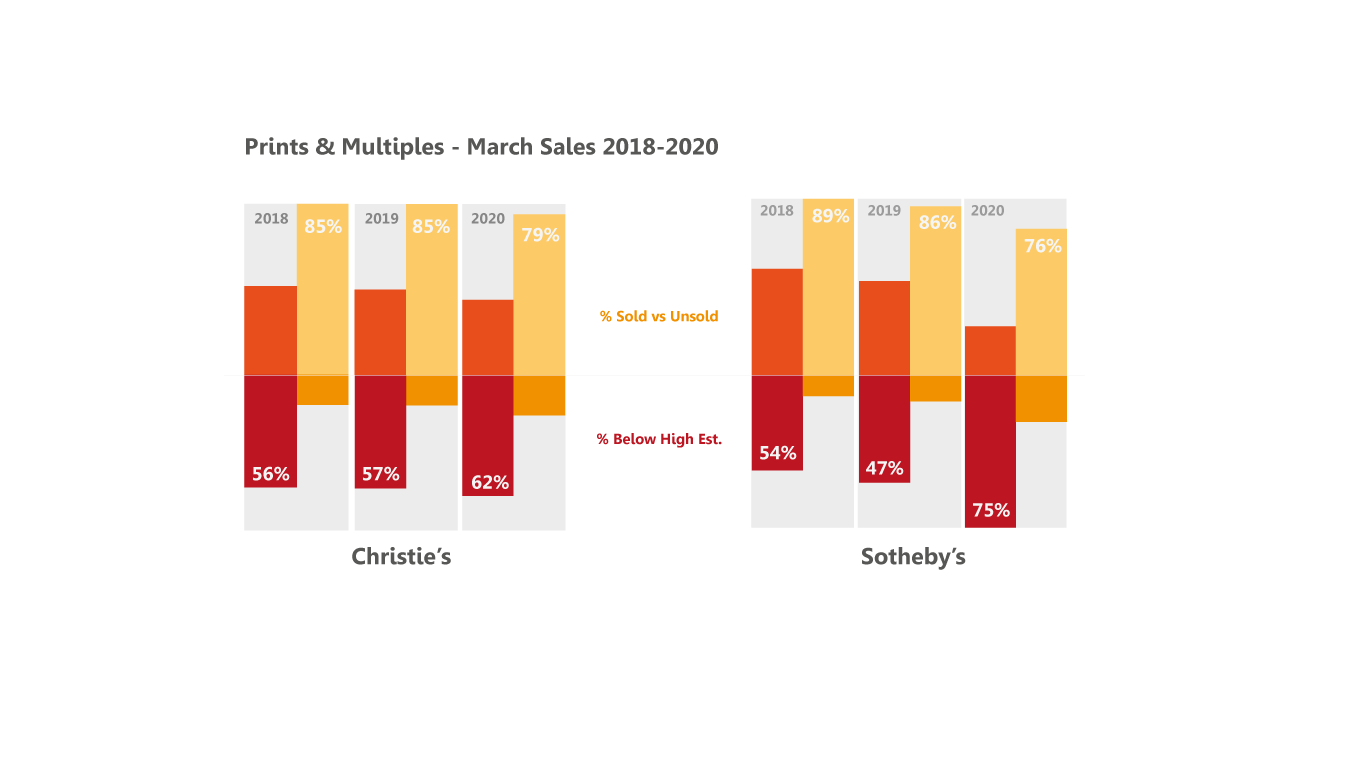

With 26 more lots on offer at Sotheby’s this year, totals sales were up over a quarter on 2019 (£3.17m incl. fees). At the same time, the percentage of Unsold Lots more than doubled (29%). At Christie’s, total sales were down 6% from 3.97m in 2019 to £3.75m. The number of lots reaching the high estimate was down at both auction houses, with Christie’s seeing a drop of 4% compared with a drop of 28% at Sotheby’s.

With total sales at Sotheby’s up and figures for individual lots down on last year, it’s clear we need to drill further into the results to understand how values have changed.

AMR has been tracking sales of individual artists at auction since the 1970s. We employ a methodology to identify the overall attitudes of buyers and sellers in the auction market and our indices are a measure artists ‘brand’ value. Last week, there were over seventy-five artists whose prints were offered for sale. We’ve grouped 47 of these together based on the fact that their works were also offered in the corresponding sales in 2019 and/or 2018. Numbering many of the Western world’s greatest print-makers, the results show how overall values of the top artists’ works have changed. The index shows that in the last twelve months these values are down 13.2% (while the overall number of lots sold remains the same year on year).

Text & Graphs Copyright © 2020 Art Market Research, All Rights Reserved

Sotheby’s Made in Britain sale

Auction Houses are already accustomed to dealing with the vicissitudes of the Art market but as governments grapple to contain the frightening Coronavirus, the industry now faces its sternest test. London’s leading auction houses have already announced significant changes to their schedule. While many online-only sales remain in place, just 6 live sales at Christie’s and Sotheby’s are set to go ahead in the next two weeks. And these sales are the best indicators of how the market is likely to react to the extraordinary events unfolding around us.

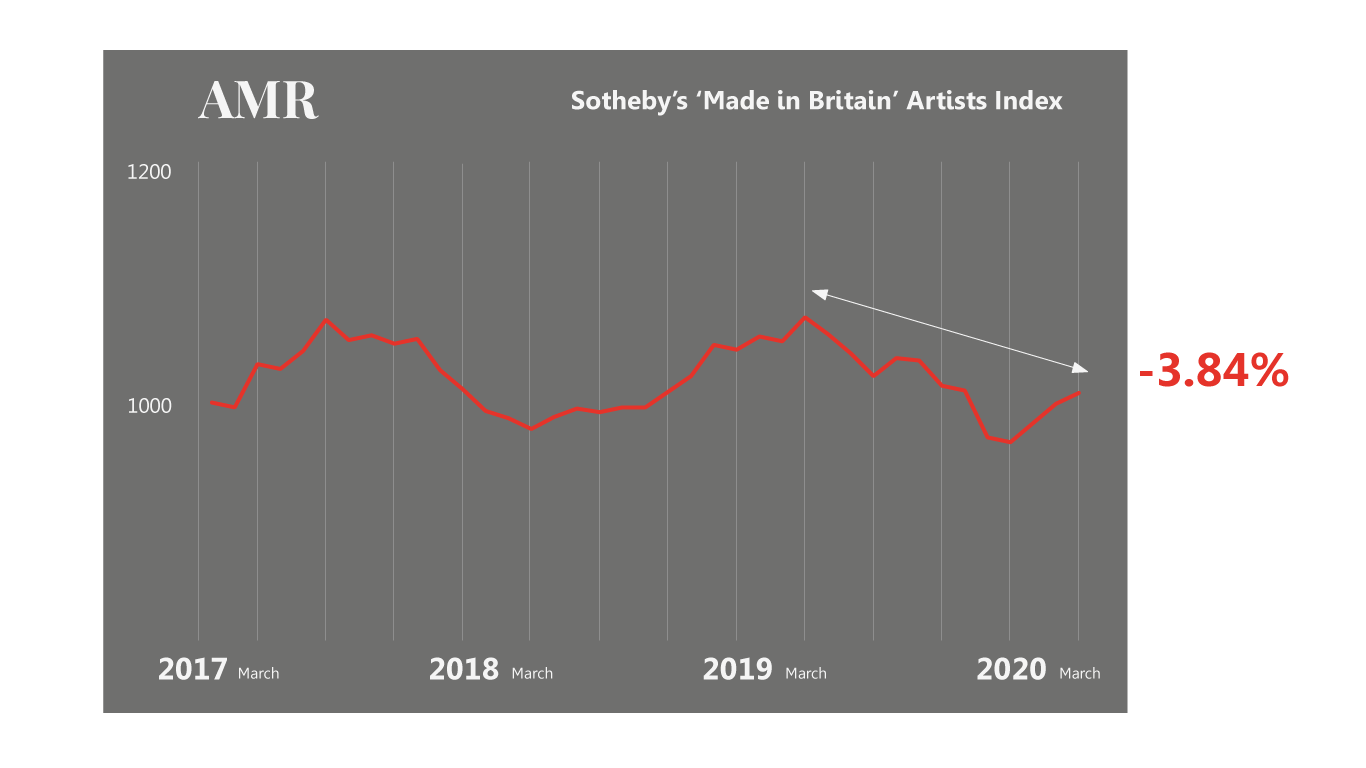

Sotheby’s Made in Britain is a fixture on the major auction sales calendar, taking place every Spring and Autumn. The most recent took place on Tuesday this week and with total sales of just over £2.1m, figures were down 15% on the same auction last year. With 33 more lots on offer, 18.5% of went unsold this week compared to 12.5% in 2019 and 8.5% in 2018. The number of lots reaching the high estimate was also down on the previous two years at 49%, compared with 57% in 2019 and 60% in 2018.

An index composed of 70 artists appearing in Sotheby’s Made in Britain sales reveals a fall of -3.84% in average values since March 2019.

As the lockdown goes global, auction houses are increasingly switching to online only or private sales. But observing government rules on social distancing, still frustrates business built around the marketplace. AMR’s experts collect data on a wide range of fine art, antiques and collectables and we’ve spoken to them about the unprecedented changes auction houses are making to stay in business.

CARS

Car auctioneers are accustomed to sold lots leaving under their own fumes and so they probably have most to lose under the current restrictions on social distancing. Bonham’s Goodwood 2020 event may have been cancelled, but the sale went ahead until the deadline on Sunday. Bonham’s website indicates that just 11 out of the 185 lots were sold as many clients are unwilling to spend if they can’t collect their cars. Brightwells have chosen to run online sales for modern cars and Ministry of Defence vehicles only. To make life a little easier, they are waiving their usual storage charge during the lockdown, normally up to £25 a day. With immediate payment for lots still expected, however, only a few collectors will be in the mood to keep shopping. Enthusiasts are already grabbing the opportunity to get on with home restorations, and parts suppliers are currently staying open to cope with the demand. Once restrictions are lifted, expect plenty of newly-restored/fettled cars coming on the market.

Note on METHODOLOGY

AMR collects data from leading auction houses worldwide providing a statistical sample of global sales at auction every month. Buyer’s Premiums levied by auction houses are removed and hammer prices recorded. Works are individually sorted and filtered and categrorised by medium to produce consistent, high quality data which is fit for purpose. Statistical outliers (data points that differ significantly from other observations) are removed (trimmed) and a times-series methodology is applied in order to identify trends. For more information on methodology, please visit AMR Methodology page.

Disclaimer: This Art Market Updates are not intended as investment advice and nor does AMR warrant that the information contained in the Update can be used for investment purposes. For more information on terms and conditions please read AMR Terms of Use.

- For more information contact s.duthy@artmarketresearch.com

Copyright © 2023 Art Market Research, All Rights Reserved